Bitcoin birthday, time to remember why we are here

Chancellor on brink of second bailout for banks

Today is Bitcoin genesis block day, literally Bitcoin’s birthday. The purpose of this article is to deep dive into Bitcoin's beginnings, what it was meant to be, what its creator's incentives were, why the collaborators were interested in contributing to its success, and what Bitcoin is achieving.

Bitcoin exists to solve a problem.

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.

Satoshi Nakamoto, February 11, 2009

In this post, Satoshi reveals the main problem: central banking, how this institution has abused the trust we have put in them. Bitcoin is an alternative to a “broken” or corrupt monetary system that it’s been running and stealing from people for centuries, creating credit bubbles with their debt-based fractional reserve banking system

Ponzi nature of banking system

For those who don’t understand this system and its corrupt and inviable nature, think about it as a rigged musical chairs game.

When the music (trust in the banking system and its currency) is on, everyone is happy playing the economic game. Economic activity is soaring; we see new businesses, new products, cheap credit, high lending, asset prices inflate, and people consuming more (thus pushing the economic numbers higher). Everything seems to be okay. But then something happens.

Under this monetary game, deposits are chairs and depositors are players; as the game goes on, there are always more players than chairs or depositors than deposits because banks “lend” currency that they don’t have. When the music (trust in the bank) is stopped, the game is over, and many people lose their chairs (their deposit), creating deflationary recessions and economic crises.

When this happens, everything starts trending the exact opposite way. The economic activity starts slowing down, debt problems arise, bankruptcies occur, people lose their jobs and consume less, asset prices deflate, until the central bank intervenes and the cycle starts again.

This is officially known as the “economic cycle,” and it's sold to us as a natural phenomenon. But the truth is this is a pure central bank–artificially created cycle by monetary manipulation, as we can learn from the Austrian school of economics.

I call the central bankers the market wizards because they hold the lever to manipulate the economic game. They are the money masters, the financial alchemists, the kings of the economic and financial game of commerce where all economic agents operate under.

Bitcoin is a revolution against the central bank monarch, but Satoshi was not shouting about this to the four winds. He didn’t want to get attention before Bitcoin was strong enough, because it would have implied a great risk to its success. Central banks are the most powerful institutions on earth; they literally have the power to create currency in unlimited amounts and buy anything they need to maintain their monopoly.

If we need a more clear confirmation of this, we can look into the encrypted message that Satoshi left in the genesis block. To understand the genesis block, imagine a bookkeeping ledger that adds new pages (blocks) daily and contains a record of all bitcoin transactions ever made. The very first page of this book is called the genesis block.

Chancellor on brink of second bailout for banks

Satoshi Nakamoto 03 January 2009

Here’s the newspaper cover he was making reference to.

In allusion to the bank bailouts that were taking place at the time, Satoshi included this intriguing line in the genesis block when he created Bitcoin during the Great Global Financial Crisis. In addition to providing the remedy, those who caused the issue (and profit from it) were making unprecedented profits.

This game is about privatizing profits and socializing losses. This is the opposite of free markets and capitalism. It's clear that Satoshi Nakamoto, whomever he was, detested the established financial system. Since the Bank of England, which was the subject of this article, was established in 1694, we may trace the debt based fractional reserve banking system history back at least 331 years.

This allusion to traditional banking's shortcomings was a declaration of what Bitcoin was trying to combat: fractional reserve banking and its consequences, which include debt, taxation, and inflation.

The bookkeepers

In essence, banking and money management are bookkeeping, keeping track of who owns what and who owes what. Due to its revolutionary impact on accounting, Bitcoin has been dubbed "triple entry bookkeeping" by some.

These days, banks are in charge of bookkeeping; they basically have the authority to make changes to the books and add new entries, or "print money." Inflation is basically a robber of time, energy, and wealth from everyone using that currency denomination, and banks are the ones who create it. Additionally, they have the ability to cause economic crises and market crashes for their own financial gain, making them deflation inductors.

The incapacity of gold (real money) to meet the demands of a growing global economy gave banks this authority. They essentially became gold safe-keepers and gold IOU bookkeepers' ledgers because people trusted these organizations to provide scalability and lower the cost and risk of gold transactions.

The purpose of banking was to enable credit and payments. Governments and banks did not create money. The free market determined the value of gold and silver, and people only trusted banknotes that were backed by gold.

“Gold is money, everything else is credit" JP Morgan, 1912.

Since banks began growing, they have sought to increase their size even more. When they discovered that the metal money system was restricting their ability to increase credit and bank profits, they literally plotted to seize control of the money market and overthrow governments by demonetizing these metals, effectively eliminating the demand for money in general and substituting it with debt and credit instruments. Essentially promissory notes issued by banks based on debt.

"The borrower is a slave to the lender, and the wealthy dominate the poor”. Proverbs 22:7

Human history is a chronicle of the literal plot by banks to enslave humanity, which resulted in hundreds of wars, thousands of assassinations, and the loss of millions of innocent lives in order to fulfill the banksters' objective of creating a global fractional reserve credit system. The currency that they decided to control? The term "U.S dollars" is frequently and incorrectly used to refer to Federal Reserve Notes.

Slavery is essentially personified in this system. Slavery, in my opinion, is working for a currency that someone else can print without any effort or labor. This is the underlying cause of legal inequality. Theoretically, we live in a democracy and capitalist society where everyone is treated equally, but income taxes and central banking are vital components of the communist manifiesto.

Where do we draw the boundary between a free human being and a slave citizen, given that this system directly violates private property rights? You are 100% slave when you pay 100% taxes, and 40% slave when you pay 40% taxes. It is being violently imposed upon you if it is not a voluntary business deal. Violence or the threat of losing your freedom are used to compel people to pay taxes.

Natural law, often known as moral law, states that every person has the right to keep all of the fruits of their labor. However, this fraudulent financial system is robbing everyone of their means of trade, whether they are called coins, currencies, deposits, checks, etc. Furthermore, ceasing to feed a parasite is the only way to eradicate it.

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

Satoshi Nakamoto, October 31, 2008

What backs fiat currencies?

The worst aspect of this system is that it views people as collateral cattle for the currency's purchasing power. In essence, "government currencies" are credits of their corresponding debts, or government bonds, which are effectively secured by the government's “authority” to impose taxes on its populace. In essence, the government's power to compel its people to give them X percent of their income without providing them with equal recompense.

In essence, citizens' wealth is "baking" the government's debts. Since the currency cannot be exchanged for wealth at a particular rate, it is inaccurate to state that it is backed, thus I said "baking." However, if we must identify a valuable component of the currency, it is as follows: wealth and labor (i.e., human time and energy).

And what makes up this wealth? Among other things, land, homes, resources, businesses, and human time. They have demand for trade and exchanges because they make up half of every transaction. However, what do people trade more for currency? Energy and time.

Those who can produce currency out of thin air with little effort (simply adding numbers to the bank ledger) can effectively steal from everyone else who has to labor and invest time and energy (real wealth), as most people exchange their time and energy for currency. Clearly, this is the root cause of inequality.

Not only is this utterly immoral and unfair, but it gets worse. The worst aspect is not that they want to charge interest and can easily generate currency, but rather that they insist that WE repay them!

What am I saying? Every currency unit's counterpart in government bonds is a public debt that generates compound interest on a continuous basis. There is a dollar due plus interest for every dollar that exists. In essence, this debt is a claim on the nation's wealth, which includes the labor (time and energy) and wealth of its citizens.

And to whom is this debt owed? The banks. Therefore, if we apply common logic, it is easy to see that just as borrowers are slaves to lenders, governments and "we the people" are slaves to banks.

However, what precisely do we owe? What kind of material have they given our governments? Is it wealth of any sort, whether it land, gold, or resources? No, it's not. is essentially a promissory note issued by a private bank, a document that serves as a means of exchange and may be produced in an infinite quantity. A counterfeit check.

Global slavery to the banks is the price we pay for a scalable medium of exchange!

And now we have a great substitute!

To sum up, we spend our lives, precious time, energy, stress, suffering, and effort to obtain these currencies and pay our taxes, while another group sits there making up new reasons to add currency the ledger —also known as "printing digital money"—that we must repay plus interest! It's crazy.

The worst aspect is that because the debt exceeds the amount of money in circulation due to compound interest, which keeps accruing and increasing the loan's size, it is mathematically impossible to pay back.

It is equivalent to burning the currency because we pay taxes to cover the interest on an ever-increasing debt that we are unable to pay back. A black hole for taxpayer funds, debt-based currencies are essentially human slavery that is supported by banks and maintained by governments.

Why isn't everyone voicing their disapproval and exposing this? The answer is brainwashing and a lack of knowledge. Much of this has been concealed or esoteric, and a major contributing factor to this blind spot is the misinformation we receive regarding the operation of this system. In order to play the game the way they want us to and avoid the game ending anytime soon, we are given a children's interpretation of human history and reality.

Libertarianism

Bitcoin's libertarian nature cannot be disregarded; even Satoshi acknowledged this when he stated:

It’s very attractive to the libertarian viewpoint if we can explain it properly.

I’m better with code than with words though.

Satoshi Nakamoto, November 14, 2008

Libertarianism is a political philosophy that holds freedom and liberty as primary values. Many libertarians conceive of freedom in accord with the Non-Aggression Principle, according to which each individual has the right to live as they choose, so long as it does not involve violating the rights of others by initiating force or fraud against them.

Libertarians advocate for the expansion of individual autonomy and political self-determination, emphasizing the principles of equality before the law and the protection of civil rights, including the rights to freedom of association, freedom of speech, freedom of thought and freedom of choice. They generally support individual liberty and oppose authority, state power, warfare, militarism and nationalism, but some libertarians diverge on the scope and nature of their opposition to existing economic and political systems. 1

Here are several arguments in favor of Bitcoin's libertarian nature.

Non-Aggression Principle: Unlike taxes and fiat currencies, which are supported by state aggression, Bitcoin is supported by energy, math, and processing power. The monopoly of violence “belongs” to governments, and banks use this authority to compel everyone to follow their rules (I'm talking about business).

Personal independence: Bitcoin doesn't require confidence and doesn't have counterparty risk. With bitcoin, the person has complete control over his finances and doesn't require "permission" from a third party to earn, save, or spend it. Bitcoin is referred to be "freedom money" for this reason.

Equality before the law: Unlike the actual banking system, where a group can create money out of thin air with little effort and can alter the rules to suit their interests, the bitcoin protocol ensures that everyone is playing by the same rules and that there is no possibility of cheating or inflating the supply of bitcoin. Equality exists under the Bitcoin protocol.

Indeed there is nobody to act as central bank or federal reserve to adjust the money supply as the population of users grows.

Satoshi Nakamoto, Febrero 18, 2009

Freedom of speech: To uphold justice and the truth in an era of widespread censorship, freedom of speech is an essential human right. The fact that Bitcoin is information also fits into this category; money is a means of conveying value, but this time in an unstoppable manner that is impervious to censorship.

Freedom of thought: Using bitcoin does not require you to subscribe to any particular philosophy or set of beliefs, including libertarianism or anarchism. Bitcoin is unbiased and doesn't care.

Freedom of choice: Unlike fiat currencies, where you frequently have no other choice, no one will compel you to use bitcoin.

Libertarians reject the current political and economic structures because they are blatantly immoral, criminal, and illegitimate. It is "shaped" by indoctrinated mob rule democracies, supported by violence, and based on lies.

"The whole idea of having an independent currency, rather than just more private or censorship resistant payments for existing currencies, didn't exist among either cypherpunks or academic cryptographers until libertarian futurists introduced it."

NICK SZABO, 2019

Bitcoin's ascent

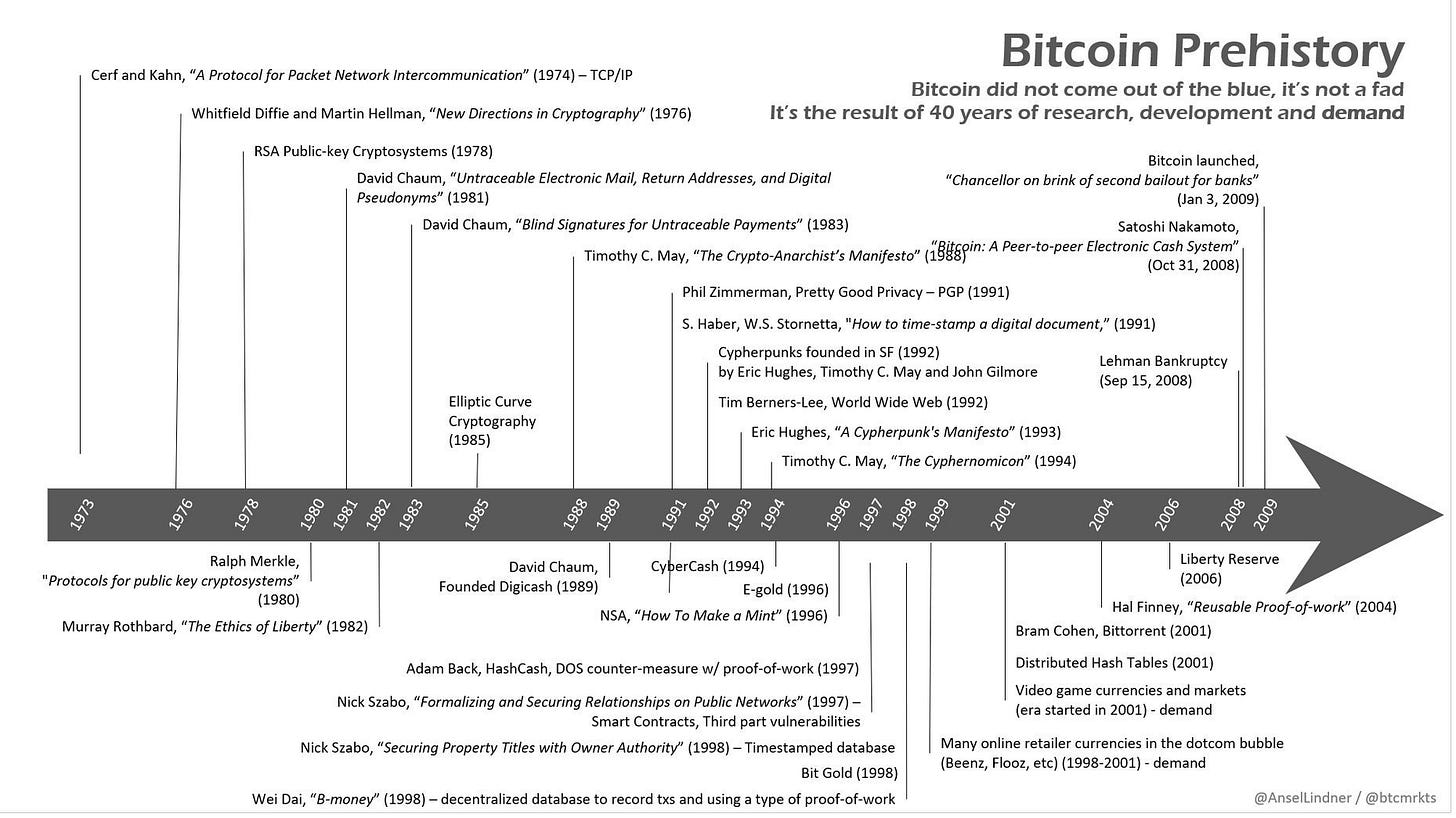

Bitcoin wasn't created overnight; rather, it was the result of decades' worth of research, development, and technology. Above all else, however, bitcoin represented a breakthrough—a new method of accomplishing tasks that had previously been impossible.

A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990's. I hope it's obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we're trying a decentralized, non-trust-based system.

Satoshi Nakamoto, Febrero 15, 2009

Due to their centralization and unique points of failure, all of the numerous attempts to implement alternative e-currencies failed. The distributed nature of the bitcoin network makes it more robust and challenging to attack.

The secret to developing a decentralized unchangeable ledger was Satoshi's solution to a problem that had been thought to be intractable since the 1970s. Following years of failure and lessons learned, Satoshi established a finite amount of money that is governed by processing power and energy.

The proof-of-work chain is a solution to the Byzantine Generals Problem.

Satoshi Nakamoto, Febrero 15, 2009

The return of money

Bitcoin has also had a significant impact on the monetary front, particularly on the system's capacity to function as money and not simply a currency. It has been shown to be the best store of value (SOV) in addition to being an excellent medium of exchange (MOE).

Since currencies replaced money during the last century, we have lost track of what money is. And in order to protect our wealth, we need to be aware of the important distinctions between these technologies.

A currency must be recognized, divisible, fungible, portable, and widely accepted in order to function as a medium of exchange.

All of those qualities are present in money, but it also has the capacity to hold value over time, and it must be scarce in order to function as a store of value. A currency, in contrast to money, is susceptible to inflation due to its ease of replication. This is the cause of the constant price increases.

The money supply needs to be scarce in order to preserve its purchasing power over time (i.e., to be immune to inflation). For thousands of years, gold and silver have been the preferred forms of money.

At first, paper currency was only used to facilitate transitions by serving as a convenient alternative (derivative) to precious metals. Since goldsmiths and subsequent bankers used fractional reserve banking to lend more money (i.e., print more paper currency) than they actually had in storage, paper currencies—which are easily reproducible—have always been vulnerable to inflation. This resulted in the recurring "bank run" crises that are documented throughout history.

But before bitcoin, we didn't have any money since 1933 because banks had taken it and devalued it. Real state, stocks, bonds, and other choices had been selected as alternatives due to the absence of money (a store of value). People buy real estate, stocks, and bonds to protect their wealth because fiat currencies are continually being inlfated, not because they love them.

An estimated 900 trillion dollars' worth of wealth is held in financial and tangible assets worldwide.

In real state, 330 trillions (36.6%)

Bonds worth 300 billions (33.3%)

Currency totaling 120 trillions (13.3%)

Equity of 115 trillions (12,7%)

Art worth 18 billions (2%)

Gold worth 16 trillions (1,77%)

Automobiles and collectibles worth 6 trillions (0,66%)

Bitcoin worth two trillions (0,22%)

Bitcoin only makes up about 0.22% of the world's total wealth. The greatest money ever created, property that you can actually own, with a sovereign protocol, no counterparty risk, a limited supply (better than scarce), and no need for banks or governments. Freedom money is unaffected by debt, taxes, or inflation.

A bitcoin market cap of x10 ($1,000,000) would represent 2,22% of the world's wealth, and a market cap of x100 ($10,000,000) would represent 22,22%.

The denominator, the dollar, is always losing value since it is created infinitely by continuously increasing the debt supply, and wealth is not fixed—rather, it is eternally increasing. According to CBNC the U.S. national debt is rising by $1 trillion about every 100 days.

Bitcoin is energy

Bankers and significant international leaders are aware that energy is the foundation of all human activity. They are aware that they must control the energy sources, including their supply, distribution, and price, in order to establish a monopoly over every industry and a system of slave labor. They even clarified in several released documents that this is the only way to engineer the global economy.

:Silent Weapons for Quiet Wars explains:

In order to achieve such sovereignty, we must at least achieve this one end: that the public will not make either the logical or mathematical connection between economics and the other energy sciences or learn to apply such knowledge.

It is only a matter of time before the new breed of private programmer/economists will catch on to the far-reaching implications of the work begun at Harvard in 1948. The speed with which they can communicate their warning to the public will largely depend upon how effective we have been at controlling the media, subverting education, and keeping the public distracted with matters of no real importance.

The Harvard Economic Research Project (1948-) was an extension of World War II Operations Research. Its purpose was to discover the science of controlling an economy: at first the American economy, and then the world economy. It was felt that with sufficient mathematical foundation and data, it would be nearly as easy to predict and control the trend of an economy as to predict and control the trajectory of a projectile. Such has proven to be the case. Moreover, the economy has been transformed into a guided missile on target.

As we can see, the actual monetary system was created as a system of control (SOC), which is essentially founded on thievery and has restrictions, barriers, closed doors, a lack of transparency, and different rules for different actors. Through fabricated inflation and economic crises, it has been stealing our riches and freedom and controlling not just the electrical supply but also the social energies of humanity. (Inductors and economic conductors)

However, Bitcoin is restoring our freedom. A way to make money, save it, and spend it without any restrictions, inflation, or capricious regulations. A novel kind of property that is not dependent on a counterparty, like banks or governments, and that requires energy to manufacture rather than being formed spontaneously.

Bitcoin generation should end up where it's cheapest. Maybe that will be in cold climates where there's electric heat, where it would be essentially free.

Satoshi Nakamoto, August, 2010

This fact is key to unlock the benefits of deflation that had been opaqued by the artificially created inflation.

Natural deflation

The primary benefit of bitcoin is deflation. Deflation incentives people to delay consumption and save more. Saving is the key to economic growth, because it can help to increase investment and productivity.

With the increase in productivity, prices tend to go down as they are more abundant and we find cheaper ways to produce thanks to technology.

The only reason that prices are not going down today -except in products where improvements are very rapid (e.g., computers)- is because of government-caused-currency inflation.

They have been stealing the benefits of natural deflation from us, but now we can access it thanks to Bitcoin.

It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self fulfilling prophecy.

Satoshi Nakamoto, 1/17/2009

Conclusion

To only way to scape the slavery system is to earn, save and spend bitcoin; a money that’s not controlled by the governments and banks, that is not subject to inflation and where everyone has to play under the same rules.

Happy birthday Bitcoin!

Bitcoin or Slavery!

https://en.wikipedia.org/wiki/Libertarianism